Nvidia replaces Intel in the Dow Jones index

Intel will be out of the Dow in a week's time. The company is now worth much less than Nvidia in terms of market capitalization.

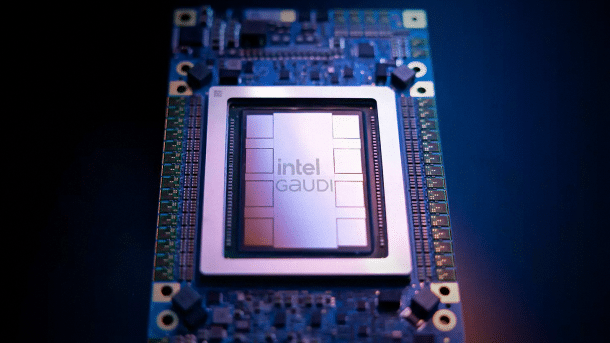

Intel's AI hopeful Gaudi 3 is not gaining momentum.

(Image: Intel)

On November 8, 2024, Intel will have to vacate its place in the Dow Jones Industrial Average after 25 years. The index tracks what analysts consider to be the most important and most valuable companies listed in the US. Intel's place will then be taken by Nvidia.

As Dow Jones states in its announcement (PDF) on the change, this was "indicated in order to achieve a better representation of the semiconductor industry" in the index. In other words: Nvidia is now much more important than processor pioneer Intel in purely financial terms. This is not surprising.

Intel has lost 54 percent of its stock market value so far this year, while Nvidia has gained 170 percent. This week, Intel also reported the largest losses in the company's history, at 16.6 billion US dollars for the last quarter. Despite good cash flow, these losses are largely only on paper, but such reports still have a long-term impact on the stock market. In the short term, however, Intel's share price rose after the last quarterly report.

The market value of a company is also decisive for the formation of a stock market index. According to the latest closing prices, this is only around 99 billion US dollars for Intel. Nvidia, on the other hand, is worth 3.3 trillion US dollars in purely stock market terms, and its shares have been soaring for two years after the AI boom.

Videos by heise

AI hype instead of dotcom bubble

The situation of the two companies is currently roughly comparable to 1999, when Intel was included in the Dow. At that time, the dotcom hype reached its peak with new online companies and the advent of everyday Internet use. This was still predominantly with PCs, and Intel was able to record double-digit growth rates from quarter to quarter. Today, this is the case with AI accelerators, which are being snatched out of Nvidia's hands.

Intel is still barely in the game. In the conference call with analysts following the presentation of its quarterly figures, the company also announced that the planned sales of its AI accelerator, known as Gaudi, will be missed in the next quarter. As reported by Reuters, among others, the planned 500 million US dollars turnover for Gaudi will not be achieved. According to CEO Pat Gelsinger, this is partly because Intel now wants to market its Gaudi 3 as opposed to the second generation and there are problems with the software.

(nie)