Raspberry Pi plans to go public

The microcomputer company is going public on the London Stock Exchange for the second time. Raspberry Pi Ltd. wants to raise fresh money for new projects.

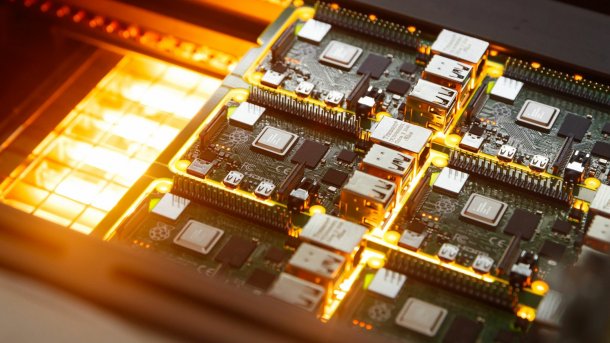

(Image: Raspberry Pi Foundation)

The British manufacturer of the Raspberry Pi is getting serious about its IPO. The company has opted for the London Stock Exchange and is aiming for a listing on the main market of the London Stock Exchange. This is according to the IPO documents published by Rasbberry Pi Limited on Wednesday. Company founder Eden Upton had previously confirmed the plans to the financial service Bloomberg.

There had already been rumors in 2021 that Raspberry Pi was planning an IPO. Although these were denied for a long time, Upton announced in early 2024 that an IPO was being prepared. With the IPO, the company is aiming for a valuation of around 500 million pounds (around 581.5 million euros). According to the Cambridge-based company, turnover rose by 42 percent last year to 211 million pounds (around 245.8 million euros). Raspberry Pi Ltd is controlled by a charitable foundation, the Raspberry Pi Foundation.

Videos by heise

IPO to raise fresh money

With the IPO, the company aims to raise additional funds for new projects and the further expansion of its product range for professional users. Professional products such as the Compute Modules have been in high demand in recent years and now account for a large proportion of the company's business.

With its single-board computers and do-it-yourself computers, Raspberry Pi also wants to continue to appeal to schoolchildren, hobbyists and technology enthusiasts, who will remain the company's main target group, according to founder Upton. The British company has already sold 8.4 million Pis this year alone, almost 14% more than in 2023, when it sold 7.4 million units. However, this increase is not only due to the great market success, but also to a tense supply situation worldwide, which led to considerable bottlenecks in availability in 2022.

(vat)