Chinese chips: SMIC is the world's third-largest chip contract manufacturer

TSMC and Samsung are now followed by SMIC as the world's third largest chip contract manufacturer. The company produces processors for Huawei, for example.

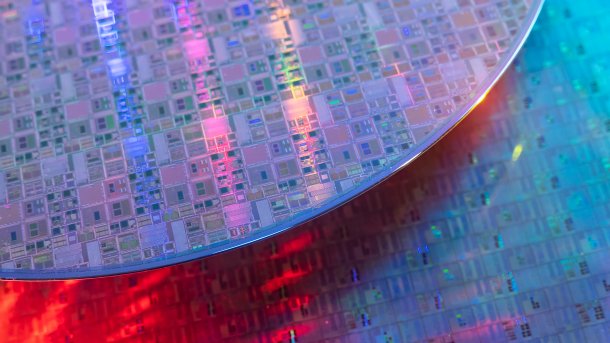

(Image: asharkyu/Shutterstock.com)

The top 5 of the world's largest chip contract manufacturers has a new ranking. In terms of turnover, Globalfoundries (GF) has fallen from third to fifth place, while the Chinese Semiconductor Manufacturing International Corporation (SMIC) has risen from fifth to third place.

This is according to a breakdown by market observer Trendforce for the first quarter of 2024. This relates purely to revenue from the production of semiconductor components for third-party companies. In the case of Samsung Foundry, chips for Samsung Electronics are included because the manufacturing division has been spun off.

Intel Foundry is missing from the list because the restructuring only took place in the second quarter. As with Samsung, Intel Foundry now sells processors to the parent company Intel.

Videos by heise

Chinese chips

SMIC has increased its turnover from 1.46 billion to 1.75 billion US dollars within one year. The chip contract manufacturer is continuously expanding its production capacity in order to meet demand in China. Due to trade restrictions, foreign competitors are only allowed to produce chips with rough structures for Chinese customers, if at all.

SMIC is China's flagship project when it comes to setting up its own chip production. Since the USA and partner countries such as Taiwan have extended trade restrictions against China, SMIC has been growing steadily. In 2020, turnover was not even half as high. The company can now produce 7-nanometer chips, but probably only in manageable quantities.

At the same time, Globalfoundries' turnover fell from 1.84 billion to 1.55 billion dollars. The annual report shows that all divisions are weakening, especially chips for mobile devices, Internet of Things (IoT) and automotive.

The Taiwanese United Microelectronics Corporation (UMC) is holding steady at a good 1.7 billion dollars – and is therefore just behind SMIC.

(Image: Trendforce)

An AI hype profiteer

TSMC remains the global market leader by a huge margin. It is the only chip contract manufacturer to benefit noticeably from the AI hype. Turnover rose year-on-year from 16.74 billion to 18.85 billion dollars. This is more than the total growth of the top 10, which together generated 29.17 billion instead of 27.3 billion dollars.

TSMC's driving force is Nvidia with its AI accelerators H100 (Hopper) and now starting B100 (Blackwell). The chip contract manufacturer is currently steadily expanding its packaging capacities in order to increase output for Nvidia. According to rumors, TSMC is also currently planning price increases.

Samsung Foundry in second place had a turnover of 3.36 billion dollars – a year-on-year decline of 89 million.

(mma)