TSMC earns more money per chip wafer

Although TSMC is hardly producing more wafers than last year, sales and profits have risen considerably.

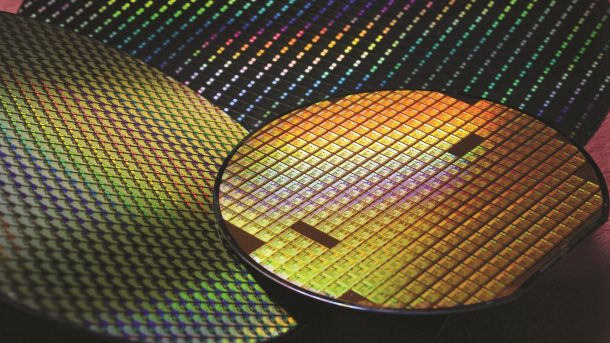

(Image: Taiwan Semiconductor Manufacturing Co., Ltd.)

The world's largest chip contract manufacturer TSMC generated sales of around 20.8 billion US dollars and a net profit of almost 7.7 billion dollars in the second quarter of 2024. This represents an increase in revenue of almost 33% within one year and a 29% rise in net profit. Calculated in Taiwan dollars (NTD), the increases are even higher due to exchange rates.

In the same period, TSMC only delivered 7.2 percent more chips to customers such as AMD, Apple, Intel, Nvidia and Qualcomm. TSMC calculates in equivalents of 300 mm wafers, whose production and sales increased from 2.92 million to 3.13 million units.

Videos by heise

3 and 5 nm are more expensive

The increase in sales is primarily due to higher prices per wafer. The industry remains silent on the details, but the largest increase is probably due to higher shares of the 5 and 3 nanometer process generations. This includes offshoots such as N4 and N4P – improved 5 nm processes.

In the second quarter of 2023, the 5-nm share of production revenue was still 30 percent; TSMC had not yet sold any 3-nm wafers. One year later, the 5 nm share has grown to 35 percent and 3 nm chips account for 15 percent.

(Image: TSMC)

The latter in particular are considered expensive due to their complex technology. The stable operating margin (42.5% vs. 42%) shows that TSMC has not increased prices disproportionately. Previous 3 nm customers are Apple, for example with the iPhone processor A17 and the M4 generation, as well as Intel with the upcoming Lunar Lake CPUs (Core Ultra 200V).

Meanwhile, the share of 7 nm chips has fallen from 23 to 17 percent – these are now considered inexpensive.

(Image: TSMC)

Impact of planned price increases

If one offsets TSMC's stated figures, the company made almost 90 percent of its turnover with chip production. The rest comes primarily from (advanced) packaging, i.e. the assembly of chips and carriers.

TSMC reports these sales exclusively in Taiwan dollars (NTD). If TSMC had already introduced the planned price increases for 5 and 3 nm wafers, revenue from chip sales would probably be around 620 billion instead of around 597 billion NTD. At the current exchange rate, this corresponds to around 19 billion instead of 18.3 billion US dollars – an increase of just under four percent.

In the current third quarter of 2024, TSMC expects revenue of USD 22.4-23.2 billion with an operating margin of between 42.5 and 44.5 percent. The first price increases could contribute to this.

TSMC shares have remained largely stable since the announcement of the business figures. Previously, Donald Trump's statements on the China-Taiwan conflict influenced the share price.

(mma)