After Nvidia, AI now also brings AMD record figures

AMD closes 2024 with record sales. For the first time, company boss Lisa Su is specific about the share of AI accelerators.

AMD's MI300 series for servers as a module and combination processor for soldering.

(Image: AMD)

For the first time in the company's history, AMD generated sales of more than seven billion US dollars in a single quarter: just under 7.7 billion dollars at the end of 2024, twelve percent more than in the previous record quarter directly before that and 24 percent more than in the fourth quarter of 2023. AMD thus also beat its previous record year of 2022: the company generated sales of 25.8 billion dollars in 2024, a good nine percent more than in 2022 and 14 percent more than in 2023.

The gap to Intel is closing further – its turnover in 2024 was only just over twice as high as AMD's. AMD is in a much better financial position: While Intel slipped into an annual operating loss of 11.7 billion dollars in 2024, AMD can increase its annual operating profit by 374 percent to 1.9 billion dollars. For the fourth quarter alone, AMD reported an increase of 155 percent to 871 million dollars in operating profit, while Intel suffered an 84 percent drop to 412 million dollars.

AMD multiplied its cash flow in the fourth quarter by 214 percent to 1.3 billion dollars. For the year as a whole, this is still an increase of 82 percent to three billion dollars. The net profit is lower compared to the same quarter last year (-28% to 482 million dollars) because AMD recently had to pay much more tax. While there were previously credits – for the fourth quarter of 2023 of a whopping 297 million –, one year later the company is paying 419 million dollars in taxes on quarterly sales. AMD is also investing more money in research and development (Q4/2024: 1.7 billion, total 2024: 6.5 billion) and spending more on marketing, general and administration (Q4/2024: 792 million, total 2024: 2.8 billion). For the full year 2024, however, AMD can report a 92 percent higher net profit of 1.6 billion dollars.

Instinct grows thanks to AI demand

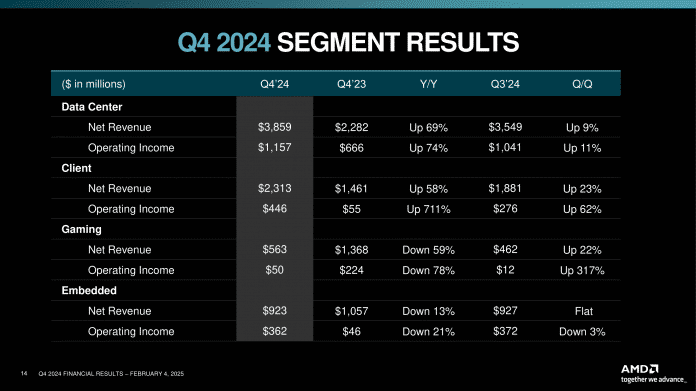

AMD's Data Center division is celebrating its greatest success: Its annual turnover is up 94 percent to 12.6 billion dollars. Even more impressive is the almost tripled operating profit of 3.5 billion dollars. Both Epyc processors and Instinct accelerators sold better.

For the first time, company boss Lisa Su gives concrete figures for the Instinct cards: they bring in sales of more than five billion dollars – thus approaching a data center sales share of 50 percent. AMD currently offers the Instinct MI300X and MI300A with an AI focus. Meta is one of the largest customers.

The client division, under which AMD offers all Ryzen processors for desktop PCs and notebooks, is also doing well. It is growing by 52 percent to an annual turnover of 7.1 billion dollars. After a small operating loss in 2023, it will also return to a healthy profit of 897 million dollars in 2024.

AMDs Umsätze nach Sparten aufgeschlüsselt (2 Bilder)

Viertes Quartal 2024

AMD

)In contrast, the two divisions Gaming and Embedded are plummeting. The former division mainly comprises Radeon graphics cards and console chips for the PlayStation 5 (Pro) and Xbox Series X/S. Due to the late product cycle, AMD sold fewer combo processors for consoles in particular. The entire group reports annual sales of 2.6 billion dollars, 58 percent less than in 2023, with operating profit falling by 70 percent to 290 million dollars.

AMD mainly counts the products of the acquired company Xilinx as embedded. Its annual turnover will fall by a third to 3.6 billion dollars, while operating profit will decline by 46 percent to 1.4 billion dollars. Embedded remains the division with the highest margin. Taking all divisions together, the company achieved a net annual margin of 49 percent (+3 percentage points).

Videos by heise

Stock market not enthusiastic

In the current first quarter, AMD expects sales of 7.1 million dollars (+/- 300 million). On average, this would correspond to growth of 30 percent compared to the beginning of 2024. Meanwhile, the stock market is not satisfied with the figures – the share price has fallen by more than eight percent in after-hours trading up to the editorial deadline.

Empfohlener redaktioneller Inhalt

Mit Ihrer Zustimmung wird hier ein externer Preisvergleich (heise Preisvergleich) geladen.

Ich bin damit einverstanden, dass mir externe Inhalte angezeigt werden. Damit können personenbezogene Daten an Drittplattformen (heise Preisvergleich) übermittelt werden. Mehr dazu in unserer Datenschutzerklärung.

(mma)