Intel: Stock market rollercoaster ride after TSMC-Nvidia-AMD-Broadcom rumors

TSMC is said to have proposed a joint venture with Nvidia, AMD and Broadcom to Intel. Intel's share price promptly shot up.

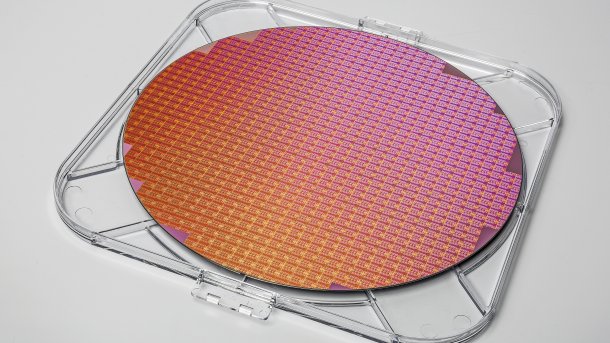

(Image: c't)

Intel shares are becoming a plaything of the rumor mill. With every new speculation about cooperations or takeovers, the value rises, only to fall again. Recently, the news agency Reuters brought a company merger into discussion, whereupon Intel's share price rose again by 10 percent.

The Taiwanese chip contract manufacturer TSMC is said to have proposed a joint venture to four US companies to take over Intel's ailing chip manufacturing division (Intel Foundry): Nvidia, AMD, Broadcom and Qualcomm.

TSMC is said to have submitted the proposal before the announcement of its own new US semiconductor plants. Despite investments totaling 100 billion US dollars, talks about a possible joint venture are still ongoing, according to Reuters. Only Qualcomm is said to no longer have any interest in Intel.

According to previous rumors, the Trump administration is allegedly in favor of a takeover of the Intel plants. However, because they would formally remain in US ownership, TSMC's share would never exceed 50 percent in the proposed constellations.

Videos by heise

AMD, Broadcom and Nvidia chips from the Intel Foundry

In establishing a joint venture, TSMC is apparently also interested in purchase guarantees: the partners are to commit to buying chips from Intel factories. Nvidia and Broadcom are reportedly already testing chips with Intel's next production generation 18A. AMD is currently evaluating the process.

After years of building new semiconductor plants strictly on its own, the global market leader is now opening up to cooperation. In the Far East, TSMC founded Japan Advanced Semiconductor Manufacturing, Inc. (JASM) in 2021, which includes Sony's semiconductor division, Denso and now Toyota. In Germany , the European Semiconductor Manufacturing Company (ESMC) is being created together with Bosch, Infineon and NXP.

The Intel Board of Directors is currently said to be in favor of a sale, but only as part of an overall package together with the chip design division for the Core and Xeon processors. This could complicate any negotiations. Broadcom's CEO Hock Tan ruled out a (partial) purchase of Intel, at least under its own management. However, a joint venture under TSMC management would negate the arguments put forward.

Meanwhile, Intel shares are subject to strong fluctuations, exacerbated by market uncertainty under the Trump administration. Since the latest rumors became known, the share price has fallen again by around five percent.

Empfohlener redaktioneller Inhalt

Mit Ihrer Zustimmung wird hier ein externer Preisvergleich (heise Preisvergleich) geladen.

Ich bin damit einverstanden, dass mir externe Inhalte angezeigt werden. Damit können personenbezogene Daten an Drittplattformen (heise Preisvergleich) übermittelt werden. Mehr dazu in unserer Datenschutzerklärung.

(mma)