AMD: Processors and GPU accelerators are running splendidly

Although the start of the year is seasonally weak, AMD recorded the second strongest quarter in the company's history.

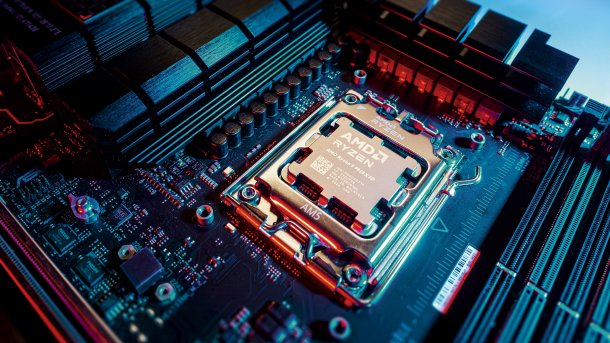

(Image: c't)

AMD's turnover is growing by 36 percent year-on-year: while the company's turnover in the first quarter of 2024 was just under 5.5 billion US dollars, it was a good 7.4 billion at the beginning of 2025. The operating profit looks even better, increasing by a factor of 21 to 806 million dollars. Net profit increases by a factor of almost 5 to 709 million dollars, cash flow by 80 percent to 939 million dollars. AMD records 50 percent net margin. At the beginning of 2024, AMD was barely profitable.

According to AMD's report, growth comes from processors for desktop PCs, notebooks and servers, as well as GPU accelerators for AI data centers. The data center group around Epyc CPUs and Instinct accelerators is earning almost 3.7 billion dollars – 57 percent more than a year earlier. The client division around Ryzen grew by 68 percent to 2.3 billion dollars in sales.

(Image: AMD)

Radeon RX 9000 apparently brings an upswing

By contrast, the gaming segment, which includes Radeon graphics cards and console chips for the Playstation 5 (Pro) and Xbox Series X/S, among others, is looking mixed. Ryzen CPUs for gaming PCs are not included. In a year-on-year comparison, gaming sales slumped by 30 percent to 647 million dollars. This is mainly due to weak console sales late in their life cycle.

But there is a ray of hope: Compared to the end of 2024, sales are up 15 percent, presumably because the first month of sales of the new Radeon graphics cards RX 9070 XT and RX 9070 are included in the latest figures. AMD launched them at the beginning of March.

A further 823 million dollars come from embedded products through the Xilinx takeover. Meanwhile, expenditure on research and development continues to rise steadily. AMD is now investing a good 1.7 billion dollars within one quarter – 13 percent more than at the beginning of 2024.

Videos by heise

Stability at a high level

In the current quarter, AMD is again expecting sales of around 7.4 billion dollars. This is despite the loss of around 700 million dollars due to the sale of AI accelerators to China. The US government has now banned the blanket sale of China-specific models such as AMD's Instinct MI308. AMD's share price has remained stable since the announcement of the business figures.

Empfohlener redaktioneller Inhalt

Mit Ihrer Zustimmung wird hier ein externer Preisvergleich (heise Preisvergleich) geladen.

Ich bin damit einverstanden, dass mir externe Inhalte angezeigt werden. Damit können personenbezogene Daten an Drittplattformen (heise Preisvergleich) übermittelt werden. Mehr dazu in unserer Datenschutzerklärung.

(mma)