Intel spends 1.9 billion US dollars on streamlining

Another quarter, another billion-dollar loss. Intel posts -2.9 billion US dollars, although revenues are unexpectedly high.

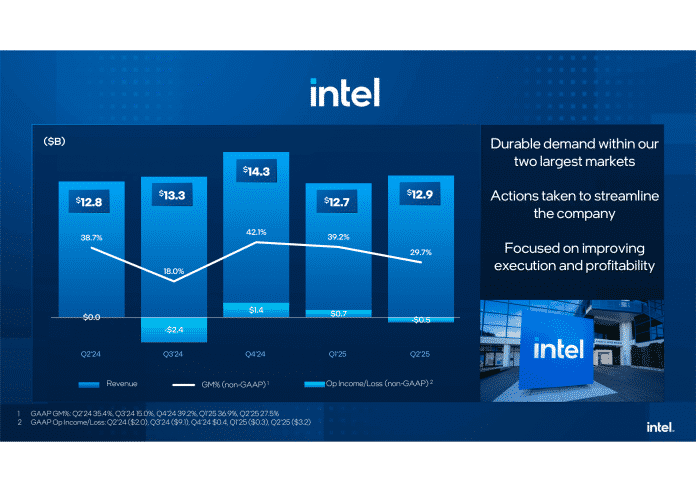

Intel generated almost 12.9 billion US dollars in sales in the second quarter – 500 million more than forecast. Nevertheless, the net loss is considerably higher than Intel itself forecast three months ago: -2.9 billion US dollars remain on the bottom line.

Chip production remains the problem child

Two huge items are dragging down the business result: chip production in the Intel Foundry manufacturing division, which remains expensive, and costs for the restructuring that has begun.

Intel books the production costs under the item “intersegment eliminations”: the design groups pay 4.4 billion dollars to Intel Foundry for the production of their processors. This price is intended to be competitive with other chip contract manufacturers, such as TSMC, but is not enough to cover the high costs of Intel's own chip production. The Intel Foundry is therefore making an operating loss of 3.2 billion dollars – 39 percent more than at the beginning of the year.

Under the item “Restructuring and other expenses,” Intel lists just under 1.9 billion US dollars. The majority of this is likely to be accounted for by severance payments after the company laid off thousands of employees. Thousands more are expected to leave by the end of the year.

As a result, the gross margin will fall to 27.5 percent. Even in the adjusted figures (non-GAAP) without the severance payments, the gross margin is extremely low at 29.8 percent. Operationally, Intel is still in the red. The operating cash flow is -3.9 billion dollars.

Client processors continue to do well

Intel continues to make most of its money with processors for notebooks and desktop PCs. The Client Computing Group (CCG) generated sales of 7.9 billion dollars, with an operating profit of 2.1 billion dollars. In a year-on-year comparison, turnover fell slightly by three percent.

Intel-Umsätze im zweiten Quartal 2025 nach Gruppen aufgeschlüsselt (4 Bilder)

Intel

)The Data Center and AI (DCAI) server division stagnated at 3.9 billion dollars in sales and an operating profit of 633 million dollars. Intel has now integrated the network division (NEX) into the DCAI Group. Retrospectively added together, turnover increased by four percent.

All other divisions landed at just over one billion dollars in sales and 69 million dollars in operating profit. These are mainly the FPGA manufacturers Altera and Mobileye for automotive hardware.

Videos by heise

Hardly any improvement in sight

In the current third quarter, Intel expects sales of 12.6–13.6 billion dollars and a net loss of around one billion dollars. Since the stock market opened on July 24, Intel's share price has plummeted by around nine percent. This means that the company is no longer even worth 100 billion dollars (market capitalization).

Empfohlener redaktioneller Inhalt

Mit Ihrer Zustimmung wird hier ein externer Preisvergleich (heise Preisvergleich) geladen.

Ich bin damit einverstanden, dass mir externe Inhalte angezeigt werden. Damit können personenbezogene Daten an Drittplattformen (heise Preisvergleich) übermittelt werden. Mehr dazu in unserer Datenschutzerklärung.

(mma)