AMD's record revenue and profit increase exceed expectations, but stock falls

In addition to ongoing successes with processors, AMD is now selling more Radeon graphics cards again. However, the stock is falling again, likely due to Amazon.

(Image: AMD)

AMD achieved record revenue again in the third quarter of 2025 and also significantly increased profits. The company was not only able to rely on server processors, AI accelerators, and desktop CPUs, but gaming graphics cards and chips for game consoles also sold better again. Only the business with embedded products has slightly declined. Although the results exceed both its expectations and those of analysts, the stock price has fallen slightly. This could also be due to Amazon. It has now become known that the retail group sold a larger number of AMD shares a few weeks ago.

In the third quarter of this year, which ended at the end of September, AMD achieved total revenue of 9.25 billion US dollars. This is 36 percent more than in the same period last year, when AMD benefited from the AI boom despite gaming implosion was possible. At the beginning of August, AMD itself had expected revenue in the autumn quarter of around 8.7 billion dollars, and market observers had, according to CNBC, expected little more. At the same time, AMD was able to increase its operating profit by as much as 75 percent year-on-year to 1.27 billion dollars, and net profit, at 1.23 billion dollars, is 61 percent higher than in the previous year.

Data center remains strong, but gaming products also improve

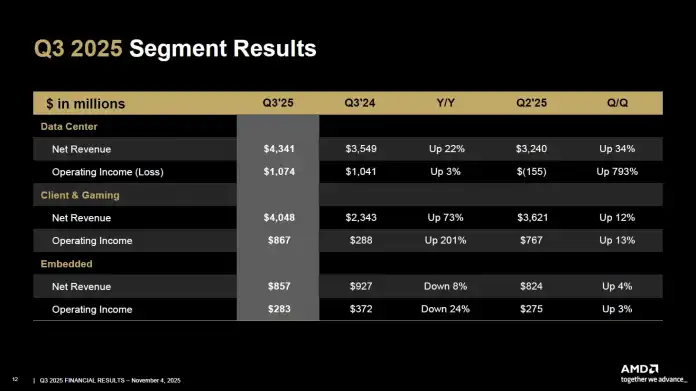

As has been the case recently, AMD could rely on its data center division as a revenue driver. Epyc server processors and AI accelerators such as the Instinct MI350 GPUs increased the quarterly revenue of this segment by 22 percent year-on-year to 4.3 billion dollars. Although the operating margin decreased from 29 to 25 percent compared to the previous year, the operating profit of this business area still increased slightly: from 1.04 billion dollars in the previous year to 1.07 billion dollars now.

AMDs Umsatz 2025Q3 nach Segmenten (4 Bilder)

AMD

)AMD's client and gaming products are growing significantly stronger. This division recorded an annual increase of as much as 73 percent and now has a revenue of 4 billion dollars. The client segment around Ryzen CPUs increased by 46 percent year-on-year to a recent revenue of 2.8 billion dollars. Gaming revenue benefited, according to AMD announcement, from increasing demand for Radeon graphics cards and semi-custom chips for consoles such as the new ROG Xbox Ally (X) handhelds with light Windows. Here, revenue increased by a huge 181 percent year-on-year to 1.3 billion dollars.

Forecast with high growth, stock falls nonetheless

Only AMD's business with embedded products recorded a revenue decline recently. Here, revenue decreased by 8 percent year on year to 857 million dollars. However, this could change again in the current fourth quarter. AMD expects total revenue to increase to 9.6 billion dollars (+/- 300 million) by the end of the year. This would correspond to an annual revenue increase of around 25 percent after AI at the end of 2024 brings record numbers to AMD after Nvidia had.

Videos by heise

Nevertheless, AMD's stock fell by almost 5 percent after the stock market closed, after already declining by nearly 4 percent during the day. However, the value of the stock has more than doubled since the beginning of the year. This is likely also a reason why Amazon has sold its previous holdings.

Amazon sells AMD shares too early

As revealed in a mandatory filing published on November 4th to the US Securities and Exchange Commission (SEC), Amazon no longer owned any AMD shares at the end of September 2025. Previously, the retail group still held 822,234 AMD shares, which Amazon had purchased at the beginning of this year. Given an AMD stock price of over $150 in September, the retail group likely pocketed more than $120 million by selling. This could have inspired imitators.

However, September was not a good time to sell AMD shares. After it became known at the beginning of October that OpenAI buys AMD GPUs for billions of US dollars, the stock market reacted ecstatically. In October alone, AMD's stock price rose by around 50 percent.

(fds)