Nvidia's AI is now part of all major chip design EDA tools

Nvidia continues its stock buying spree. New to the portfolio: The world's largest provider of EDA tools for chip designs, Synopsys.

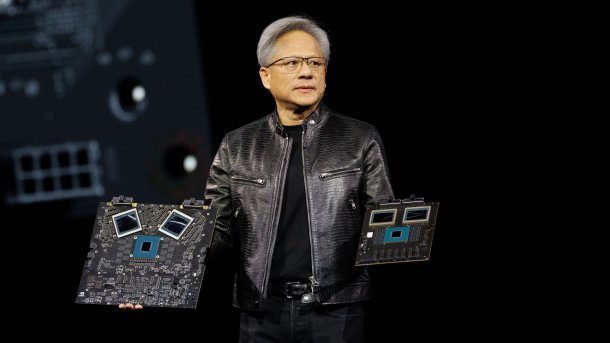

(Image: Nvidia)

Synopsys and Nvidia announce a partnership under which Synopsys will offer chip design tools with Nvidia's AI ecosystem. At the same time, Nvidia is buying Synopsys shares worth two billion US dollars.

It is the third cooperation of this kind after Siemens EDA and Cadence, but at the same time the most extensive with a company stake. Synopsys, Cadence, and Siemens EDA are the heavyweights of Electronic Design Automation (EDA) for chips. All three are thus integrating Nvidia's AI algorithms.

Cadence and Siemens EDA also operate servers with Nvidia hardware and software, but without a company stake.

Chip simulations and optimizations

The focus is on validating new chip designs, such as CPUs, GPUs, or AI accelerators. Previously, simulations of how a finished chip should behave ran on processors and often took several weeks. According to the EDA tool providers, AI simulations on GPUs should be completed in a few hours. This can be particularly useful for validating initial designs. The complex CPU simulations will remain for final validation.

Artificial intelligence can also help with the designs themselves, for example, in arranging different logic blocks to save space. Software optimization has been common for many years, and the inclusion of AI is just the latest step.

As early as early 2023, Synopsys advertised its own AI in EDA tools. At the time, the provider cited specific figures: SK Hynix was able to save five percent space in memory chips, which today is close to a leap in the manufacturing process. Synopsys also spoke of up to 25 percent less energy consumption in some chips.

Now Nvidia's software ecosystem is spreading among EDA tools, including CUDA-X, Omniverse for digital twins, Cosmos for physical AI models, and a range of tools and models for AI agents (NIM, NeMo, Nemotron).

Videos by heise

First time with a company stake

This is the first time Nvidia has acquired shares in an EDA tool provider. Nvidia is buying the shares at a price of $414.79 per share. At two billion dollars, this corresponds to just over 4.8 million shares, or a company stake of just over two percent. Nvidia thus lands among the ten largest Synopsys investors.

For Nvidia, the investment represents only 3.5 percent of its quarterly revenue. For Synopsys, two billion dollars is more than a complete quarterly revenue (last quarter: 1.74 billion dollars). The partners emphasize that Synopsys does not have to buy Nvidia GPUs with this money. Synopsys buys them regularly for its own servers anyway and intends to continue doing so in moderation.

Nvidia CEO Jensen Huang joked in a press conference: He would be happy if AMD and Intel bought Nvidia GPUs to optimize their chip designs. Nvidia itself had used their CPUs for its own designs for a long time.

Synopsys' stock rose by about eight percent since the investment was announced.

Empfohlener redaktioneller Inhalt

Mit Ihrer Zustimmung wird hier ein externer Preisvergleich (heise Preisvergleich) geladen.

Ich bin damit einverstanden, dass mir externe Inhalte angezeigt werden. Damit können personenbezogene Daten an Drittplattformen (heise Preisvergleich) übermittelt werden. Mehr dazu in unserer Datenschutzerklärung.

(mma)