Fiber optics: Monopolkommission warns of return of old power structures

The transition from copper to fiber optics is a critical phase. Monopoly watchdogs call for more regulation and minimum standards for residential connections.

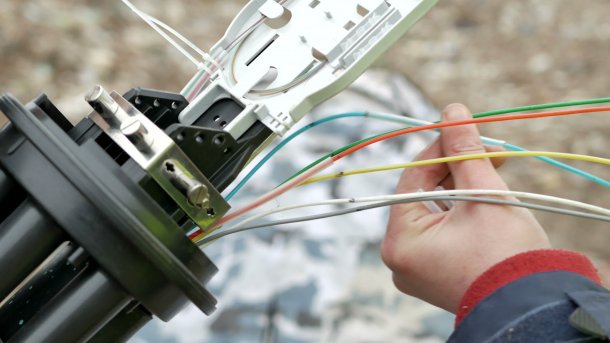

(Image: SHARKstock/Shutterstock.com)

In its 14th Sector Report on Telecommunications, published on Tuesday, the Monopolkommission sounds the alarm and strongly warns against new monopolies. The market, particularly in Germany, is in a critical transition phase from old copper technology to future-proof fiber optics, write the consultants to the federal government. In this phase, there is a risk that the former state monopolists will regain a dominant market position.

A central concern of the monopoly watchdogs, according to the report, is ensuring infrastructure competition in fiber optic expansion. Where it is economically sensible, priority should be given to ensuring that two or more providers lay their own, independent fiber optic networks, it states. This secures competition in the long term for the benefit of consumers. In other cases, stronger supervision by the Federal Network Agency is necessary.

Apartment: Four fibers should be the standard

In addition, the commission recommends a clear minimum standard for apartment connections: each household should be equipped with at least four fibers of a fiber optic cable. This would allow different providers to use the connection and simplify switching for consumers significantly.

The competition experts see particular urgency in the contested copper-to-fiber migration, which is decisive for the future market structure in the fixed-line network. Without clear and decisive regulations for the shutdown of old copper networks, Deutsche Telekom has an incentive to strategically expand fiber optics first in areas where alternative providers are already active in order to push them out of the market. The regulatory authority must therefore urgently transition from its current moderating role to one of decisive action.

Videos by heise

At the same time, the Federal Network Agency has published its Activity Report 2024/2025 for the Telecommunications Sector. The expansion of fiber optic networks is considered a massive infrastructure project that enables high bandwidths and short transmission times for services such as telemedicine and AI. Investments in tangible assets in the telecommunications market rose to 15.5 billion euros in 2024 (plus 4 percent compared to 2023), with a focus on fiber optic and mobile infrastructure. Despite these efforts, Germany lags behind other European countries in fiber optic expansion. One reason for this is the high availability of high-performance existing networks (DSL/TV cable).

Importance of Open Access

The regulatory authority actively supports the copper-to-fiber migration, according to its own statements, to secure competition and consumer interests. It has announced a more detailed concept for this long-term technology change for early 2026. Open access offerings, where operators open up lines to other service providers, are considered by the regulator to be the most important key to market development. However, with over 200 network operators, further progress and uniform standards are required.

In 2024, the telecommunications arbitration board recorded the highest number of annual applications since its establishment in 1999, according to the report. Customers submitted a total of 6420 requests in 2024 and 2025 (as of the end of October 2025).

Meanwhile, the Monopolkommission is attaching strict conditions to its approval of the planned Digital Networks Act (DNA) of the EU. While it welcomes the impetus for the European internal market, it warns against premature deregulation through the regulation. Companies with proven market power must continue to be subject to strict regulation until effective competition is established, it demands.

The Chairman of the Monopolkommission, Tomaso Duso, called for adherence to the EU market recommendation, with regulated wholesale access markets such as for bitstream access. This is a very important aid for the regulatory authorities. Duso described open access offers as good. However, they are often not sufficient: "Nothing is really moving forward here." The Federal Network Agency should dare to further develop this concept. The monopoly watchdogs also demand that the role of the regulatory authority be strengthened within the framework of the DNA to ensure competition-compliant migration.

Resilience of Submarine Cables

The Monopolkommission currently sees no competition problems in data exchange between network operators and large content and service providers from the Big Tech sector such as Alphabet or Netflix. Both sides negotiate on equal terms, which is why the competition experts reject a national or European dispute resolution body. Additional payments from content providers to network operators in the style of a data toll are only justified if they are the result of commercial negotiations without abuse of market power.

The resilience of European internet connectivity via submarine cables also plays a role in the report. According to Duso, the Monopolkommission has analyzed data on this and assessed the infrastructure as "actually very resilient": there are very many alternative connections, at least between Europe and the USA. State funding for international cable projects is not necessary. However, Duso pointed to bottlenecks in repair ships: there are only two of them in the Baltic Sea and the Mediterranean Sea, respectively. It therefore remains important to identify weak points and dependencies early on. Big Tech companies operate almost 90 percent of the cables.

Future of the Post

In its report on the postal sector, the Monopolkommission urges for a reduction in legal standards for basic postal services. These are considered oversized given the declining relevance of letter mail. According to the consultant, the current high requirements – such as six delivery days per week – unnecessarily drive up costs. To save money and enable lower postage prices for consumers and businesses, the committee considers five delivery days per week to be sufficient. Such a reduction is permissible under EU law.

Furthermore, the committee recommends proactively planning the adjustment of basic service standards in light of ongoing digitalization for the long term. Germany should not follow the example of Denmark for the time being, where the state-owned company Postnord intends to cease its letter delivery. The Danish case also illustrates for Duso how important private competitors are in this sector as well.

After more than 9000 complaints in July, the submissions regarding delayed or undelivered mail from Deutsche Post decreased again in the following months, explained the President of the Federal Network Agency, Klaus Müller. The company admitted to difficulties in the summer. It subsequently recruited additional staff, so the situation is now stabilizing again. In the courier and parcel services sector, growth continues, while developments in the letter segment remain in decline (almost 7 percent decrease).

(mki)