E-billing at DATEV: Confusion about activation for Duo customers and costs

Since January, self-employed people have had to accept e-invoices. This is also possible with the popular DATEV online. If you know how – and have small change.

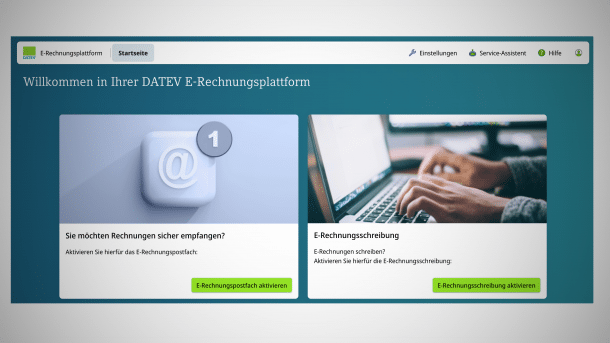

DATEV e-invoicing platform: Two accounts required.

(Image: Screenshot Datev.de)

Many self-employed people with tax advisors use the popular web-based program package DATEV Unternehmen online, or Duo for short. It allows you to easily enter invoices via upload or your own app and, thanks to the online banking connection, you can also find matching offsetting entries – or pay invoices if you wish. The data is then recorded once a month or quarter and the tax consultant can carry out the bookkeeping and prepare the advance VAT return.

With the introduction of e-invoicing in Germany on 1 January 2025, which is intended to digitize invoice transactions between the self-employed, such systems will become even more important, as the XML-based payment requests must not only be read correctly, but also stored in a legally compliant manner. And so many Duo users, who pay 13.09 euros per month (plus the usual accounting costs of the tax consultant), hoped that e-invoicing would be implemented free of charge as standard. However, this is not the case, as DATEV would have liked to have paid money for this – and not too little. And that's not all: setting up e-invoicing is surprisingly and unnecessarily complex.

DATEV sees customers twice

The linchpin of e-invoicing at DATEV is not Duo, but a completely new product called the DATEV e-invoicing platform. Confusingly, you can't simply log in there with your existing DATEV account for Duo via the Smart Login app. Anyone who tries to do so receives an error message.

"Companies are not authorized to access this page with the existing DATEV SmartCard / DATEV SmartLogin", it then says, "please log out and create a DATEV account to use the DATEV e-invoicing platform".

Videos by heise

The reason is apparently that DATEV requires a new contract for the e-invoicing platform and Duo was normally initiated via the tax consultant. Nevertheless, DATEV invoices the self-employed person directly for Duo and could take over this customer relationship, but does not do so. Instead, a completely new "DATEV account" must be created – DATEV then manages the self-employed person as two customers, so to speak. To avoid conflicts, you should use a new e-mail address.

You can then actually use the DATEV account to log in to the e-invoicing platform. But that's not all: as the account is "new" and DATEV does not know the customer (even if it has only "forgotten" them), an authentication procedure must be completed via the service provider Verimi, for which you need a passport, ID card and computer with webcam or smartphone.

Lure offer until summer

Once verification has been completed, you can create a link to Duo in the settings. An e-mail address is then created to which e-bills can be sent. – After an internal virus and validation check –, these are then forwarded "directly and automatically to DATEV Unternehmen online", where they can then be released. Duo itself only accepts e-invoices via upload if they also have a readable part (such as ZUGFeRD, which combines PDF/A and XML); pure XML documents such as those from XRechnung only work via the e-invoicing platform.

It is also possible to write e-invoices via the DATEV e-invoicing platform. However, self-employed people with a turnover of less than 800,000 euros per year will only have to do so from 2028, while those with higher turnover will have to do so from 2027. DATEV itself has informed its support team that Duo customers would be better off using a different solution.

This is because the e-invoicing platform currently does not even have the option of recording customers –, meaning that every invoice has to be written from scratch. We therefore recommend using the web app Auftragswesen Next, as it has more functions and is integrated into Duo. Cost: 7 euros per month. The e-invoicing platform itself can only be used free of charge until the end of June 2025. From then on, only 25 invoices per month will be free.

Digital invoices now with 50 cents "postage"

From the 26th invoice onwards, DATEV charges 50 cents per invoice, which can really add up. In addition, the charge applies to each individual invoice, i.e. outgoing and incoming via the e-invoicing platform (outgoing via the Next order system is covered by the monthly fee). Caution: The DATEV e-invoicing platform also accepts and processes pure PDFs – which are likely to continue to make up the majority of invoices until 2027 and can be processed directly in Duo without any problems and without an extra fee. If you want to avoid being asked to pay for such invoices as well, you should set up an additional address and continue to upload them to Duo manually (or via email forwarding). It is also problematic that the "postage" creates a potential for abuse: Attackers could come up with the idea of bombarding DATEV customers with (valid) e-invoices or even just PDFs, for which the aforementioned 50 cents per item would then be due. There is no all-inclusive price for the e-invoicing platform. You should therefore be very careful with the e-mail address generated by the e-invoicing platform and never give it to dubious companies.

In view of the pricing model, DATEV support is not aware of any guilt and points out that e-invoices by e-mail are only intended to be a temporary solution anyway. Direct invoice transmission via services such as TRAFFIQX or Peppol is considered to be the better solution. TRAFFIQX invoices themselves are initially free of charge as part of the e-invoicing platform, even after June. Now you just have to get your suppliers to use TRAFFIQX...

There are numerous other tools for reading and writing e-invoices, including free ones. The problem always remains that you have to store them in accordance with GoBD. Platforms such as Duo, but also various other accounting solutions such as Lexware, Easyfirma, Sevdesk or Wiso Firma make this easier with their cloud servers, but also create new dependencies. DATEV's e-invoice "postage" is just one example.

(bsc)