Analysis of the hype share Nvidia: Is the euphoria coming to an end?

After a spectacular high, the Nvidia share has recently stumbled. Has the hype peaked?

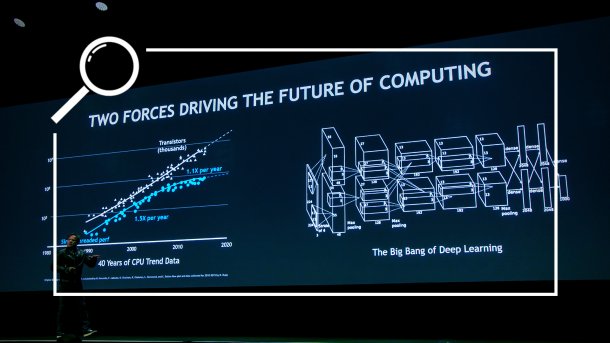

In 2017, here at the GTC in Munich, AI was also still called "deep learning" at Nvidia.

(Image: Nico Ernst)

If you thought you'd seen it all, you were proved wrong on Wall Street on Wednesday after the close of trading. At 22:20 German time, chip manufacturer Nvidia announced its new figures for the past three-month period – and the announcement of the financial statements became a pop-cultural event like a Taylor Swift concert.

In fact, investors in New York were eagerly awaiting the moment of truth like the decisive touchdown in the Super Bowl. No question: chip designer Nvidia is the cult stock among the Big Techs. Would Nvidia CEO Jensen Huang, recently dubbed the "Godfather of AI" by tech analyst Daniel Ives, deliver or not?

Huang delivered – and how. In the past quarter, Nvidia once again achieved a triple-digit increase in sales and profits compared to the same period last year. Revenues exploded by 122 percent to exactly 30 billion US dollars, while net profits even shot up by 168 percent to the fabulous figure of 16.6 billion. In other words, the world's most valuable chip designer by far currently has a fantastic net profit margin of over 50 percent. What's more, Nvidia has exceeded consensus estimates with its latest balance sheet according to every reading. Analysts were only expecting revenues of 28.7 billion US dollars and earnings per share of 64 cents –. In reality, 68 cents per share were achieved.

Wall Street's reaction to the fabulous figures alone was negative. Nvidia shares fell by 7 percent in an initial after-hours reaction; in regular trading yesterday, the sell-off was confirmed with an equally large drop. The price slide erased more than 200 billion US dollars in market capitalization within one trading day.

Nvidia is the epitome of AI hype

How can the sharp sell-off be explained? With the hype that the now 31-year-old chip designer from Santa Clara, California, has ignited over the last two years. If there is one big tech company that is seen as the epitome of AI euphoria, it is Nvidia, whose shares skyrocketed on Wall Street in sync with the launch of OpenAl's ChatGPT at the end of 2022, which heralded the age of AI. Less than two years ago, the company's shares were still changing hands for a split-adjusted USD 11 – at their all-time high in June 2024, which was more than USD 140.

Videos by heise

In other words, the Nvidia share price has risen by a peak of 1200% in around 1.5 years. These are almost astronomical increases in value, especially in view of the already high market capitalization – even in 2022, Nvida still had a market capitalization of over USD 200 billion despite a massive sell-off of tech stocks –. In 20 months, Nvidia was actually able to increase its enterprise value by around USD 3 trillion – There has never been such a rapid increase in value in the history of the capital markets. In May 2023, the US company, which is traded under the ticker symbol NVDA on the Nasdaq technology exchange, broke through the magical valuation mark of one trillion US dollars for the first time, which was previously only reserved for the exclusive big tech club of Apple, Microsoft, Alphabet, Amazon and Meta.

"Jensen Huang in the same breath as Elon Musk and Tim Cook"

Tech star analyst Daniel Ives was already giving the accolade a year ago. "I would name Jensen Huang in the same breath as Elon Musk and Tim Cook," the Wedbush analyst explained at the time. "What he has achieved here with Nvidia will be a grand slam. A historic bet that I think will put him in the top tier of CEOs. Nvidia will be a towering name in the years to come," Ives firmly declared – and was proved right.

In February of this year, Nvidia even cracked the 2 trillion US dollar mark, only to break through the 3 trillion US dollar milestone just 96 days later. This opened up the final three-way battle for the stock market throne between Apple, Microsoft and Nvidia, which the AI superstar briefly won in mid-June. With share prices of USD 140 and a market capitalization of more than USD 3.4 trillion, Nvidia became the most valuable company in the world. Jensen Huang's ascent to Olympus was accompanied by pop-cultural admiration, and he even signed the cleavages of female admirers.